Mortgage Loan Setup & Processing Outsourcing Services

Solutions tailored to reduce turnaround times and increase efficiency

Effective Services to Streamline Your Operations

We understand that loan setup and processing can be time-consuming and labor-intensive. Powered by decades of industry experience, your business can benefit from our ability to do the heavy lifting for you.

Here are some reasons why you should outsource your operations to us..

Cost Efficiency

Scalability & Flexibility

Expertise & Specialization

Improved TATs

Enhanced Efficiency

Risk Management

Access to Latest Tools

Tailored Loan Setup & Processing Services for Bankers, Lenders and Brokers

Be it changing regulations and norms or fluctuating interest rates, we’re an empathetic outsourcing partner that understands your recurring challenges. Our goal is to simplify mortgage processing for you by identifying bottlenecks, bridging communication gaps and optimizing day-to-day operations.

Improve business outcomes with a 24/7 global service delivery model and a skilled team of highly qualified professionals to assist you.

Loan Setup & Processing Solutions

Pre-Underwriting

Thorough review and assessment prior to underwriting to minimize potential risks and improve loan quality

Loan Document Indexing

Efficient organization and indexing of loan documents for easy access and retrieval

Loan Set up and Initial Disclosures

Streamlined loan setup process to ensure timely delivery of accurate initial disclosures

Generating Closing Disclosures

Generate accurate and compliant closing disclosures to provide transparency and clarity to borrowers

Loan Conditions Gathering

Collection and verification of all necessary loan conditions prior to submission to ensure there aren’t any gaps

Ordering Third Party Verification Services

We facilitate seamless ordering and verification of third-party services to validate loan information and enhance due diligence

Loan Shipping

Submission of loans to investors or secondary market participants, meeting all necessary requirements for successful loan delivery

Pre-Closing Quality Control

Rigorous quality checks and audits before closing to identify and resolve any potential issues or discrepancies

Post-Closing Quality Control

Comprehensive audits after loan closing to ensure adherence to regulations and internal quality standards

Six Reasons to Choose Us

Tailormade

Teamwork

Affordable

Focused

Updated

Secure

We don’t believe in one-size-fits-all approach

Your business is unique and you deserve a business partner who understands your needs and goals. We offer customized solutions that cater to your requirements

We won’t feel like outsourced labor

Your growth is our goal. Our team of expert professionals work as an extension of your local team, staying true to your agendas and values

Access to the top tier talent for a single flat rate

Reduce costs without compromising on quality. We offer access to skilled professionals at competitive prices

Onshore and offshore delivery models

Our global service delivery model ensures 24X7 services to ensure you reach your goals smoothly and efficiently

Stay on top of consumer privacy laws

We help you stay up to date with changing laws and regulations

Complete client data privacy

We ensure that all necessary steps are taken to keep your data secure and private

We don’t believe in one-size-fits-all approach

Your business is unique and you deserve a business partner who understands your needs and goals. We offer customized solutions that cater to your requirements

We won’t feel like outsourced labor

Your growth is our goal. Our team of expert professionals work as an extension of your local team, staying true to your agendas and values

Access to the top tier talent for a single flat rate

Reduce costs without compromising on quality. We offer access to skilled professionals at competitive prices

Onshore and offshore delivery models

Our global service delivery model ensures 24X7 services to ensure you reach your goals smoothly and efficiently

Full compliance with the consumer privacy laws

We help you stay up to date with changing laws and regulations

We won’t feel like outsourced labor

We ensure that all necessary steps are taken to keep your data secure and private

Hear From Happy Customers

We have been working with Aritas Mortgage Solutions’ team for over a decade. From loan origination to post-closing audit application, they continue to exceed expectations. We trust their work implicitly and are excited to usher in their new automation tool in order to continue to help us fine tune how our team operates.

Mortgage Banking Group

We continually recommend team AMS to our clients. This team’s expertise, ability, willingness to work and ensuring quick turnaround on the work assigned is what sets them apart. The team’s dedication and commitment to servicing its client’s requirements, coupled with deep domain knowledge makes it unique in the industry and invaluable.

Mortgage Broker

We’re extremely satisfied with the team’s performance—they have been able to understand our expectations, deliver quality results and support their responses/answers with substantive information. This team is one of the best as it knows what it’s doing.

Leading Law Firm

Real Businesses. Real People. Real Success Stories

Discover How We Simplify Mortgage Growth

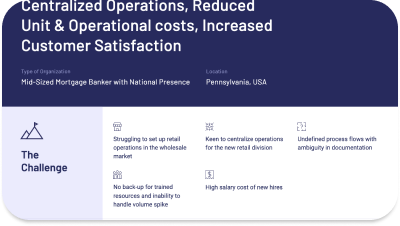

Centralized Operations, Reduced Unit & Operational costs, Increased Customer Satisfaction

Mid-Sized Mortgage Banker with National Presence

Centralized Operations, Reduced Unit & Operational costs, Increased Customer Satisfaction

Mid-Sized Mortgage Banker with National Presence

Centralized Operations, Reduced Unit & Operational costs, Increased Customer Satisfaction

Mid-Sized Mortgage Banker with National Presence

Increase Efficiency

Want to learn more about our services? Head to our contact page to submit your query or write to hello@aritasmortgagesolutions.com

Loan Setup & Processing Support FAQs

Over 15 years of industry experience helps us better understand industry-specific challenges and requirements and tailor solutions to help you meet your goals. We use the powerful combination of human expertise and optimized operations to increase loan processing speed and boost productivity. Our team of highly skilled and trained staff efficiently manages high volumes, giving you the opportunity to focus on your customers.

We understand that when you’re operating in an ever-changing landscape like the mortgage sector, it’s important to keep up with the market’s demands. Our independent but centralized QA team conducts regular audits and reviews to help you stay up to date with market circumstances. It also identifies areas of improvement and recommends impactful strategies to address revenue gaps.

As an organization that deals with sensitive client information, you’re probably wondering whether your outsourcing partner is equipped to efficiently handle data. We are an AICPA SOC2 Type2 compliant, ISO 27001 certified organization so you can rest assured that we take every necessary step to keep client data private and secure. Our staff is well-trained to manage data while maintaining confidentiality.

We’re a team of experienced professionals equipped with the knowledge and expertise to deliver quality results. You can delegate loan setup and processing services to us to enhance efficiency and reduce operating costs. We also provide a global service delivery model that ensures 24X7 services to effectively bridge communication gaps.

We’re committed to helping you keep your business up to date and leveraging the latest trends and practices for improved results. As a reliable business partner in a market that’s full of fluctuating rates and changing norms, we offer the right support required to take quick action aligned to the latest developments.