What Is a Preliminary Title Report and Why Does It Matter?

A preliminary title report is one of the first things to hit the desk when a potential sale is on the horizon. Think of it

Contents

In the complex financial sector, mortgage lenders and brokers find themselves navigating an intricate web of processes to provide homebuyers seamless services. This is where Mortgage Process Outsourcing (MPO) emerges as a strategic solution. It involves delegating certain non-core tasks of the mortgage origination process to third-party service providers so lenders and brokers can optimize operations and focus on core competencies.

In the contemporary mortgage landscape, there’s an ever-growing demand for efficient, accurate and swift mortgage origination. Loan originators manage an array of tasks, from credit checks and underwriting to documentation and compliance. Mortgage process outsourcing addresses these needs by offering specialized expertise, access to the latest tools and a scalable workforce to manage various aspects of the origination process.

According to a report by the Allied Market Research, the global mortgage lending market is projected to reach $27,509.24 billion by 2031, growing at a CAGR of 9.5% from 2022 to 2031. The mortgage process outsourcing industry’s ability to economically deliver operational excellence has supported this growth. Presently, when the mortgage sector has been facing constant fluctuations, lenders are looking for ways to reduce costs. Some US’ leading lenders like US Bank, JP Morgan and Wells Fargo have already started laying off staff. Brokers on the other hand want to focus on gaining new clients and are seeking full processing support. Both can benefit from outsourcing operations to an experienced, third-party partner and improve efficiency without hiring more people.

In this guide, we will unravel the complexities of mortgage process outsourcing—its benefits, challenges and key considerations for loan originators. But first, let’s understand why the outsourcing industry is now integral to the mortgage ecosystem.

Mortgage Business Process Outsourcing (BPO) offers an array of effective solutions that mortgage lenders and brokers can benefit from.

In the realm of mortgage process outsourcing, a one-size-fits-all approach often falls short of meeting lenders’ and brokers’ diverse and dynamic needs. A customized approach is necessary to achieve operational excellence and differentiation. This is where we step in with comprehensive mortgage process outsourcing services.

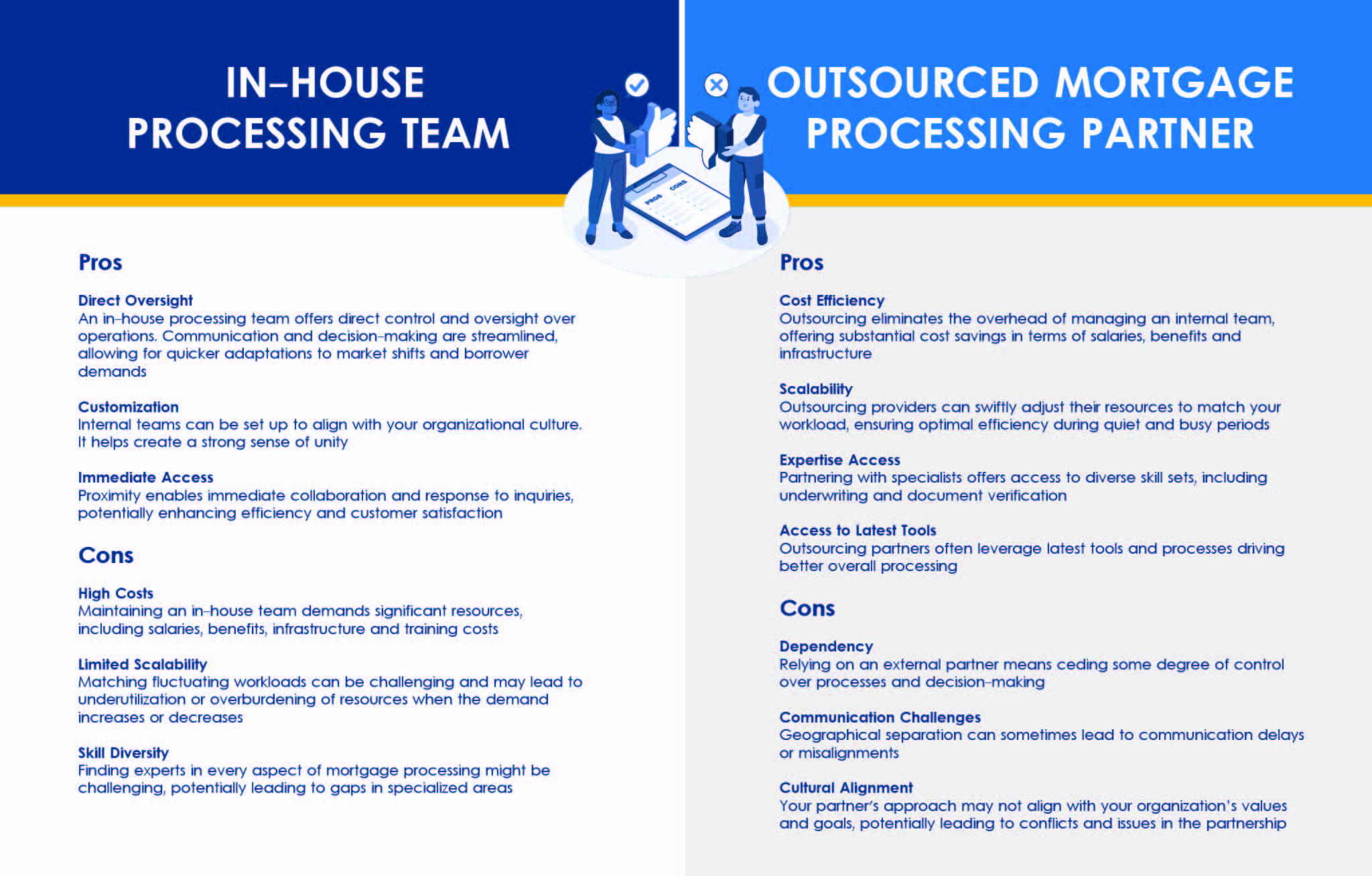

The mortgage industry, like many sectors, is affected by economic uncertainty and shifting interest rates. The 30-year fixed rate mortgage will average 6.8% for Q3 2023, according to Fannie Mae’s July Housing Forecast. In addition, with the Fed determined to meet its inflation rate target of 2%, lenders and brokers must be careful to tactfully navigate the market. In this context, the decision between maintaining an in-house processing team or partnering with an outsourcing provider becomes crucial. Let’s weigh the pros and cons of both.

Pros

Cons

Pros

Cons

Elevate your mortgage operations with us our tailored, affordable solutions that will address your unique business needs and goals. Our collaborative solutioning approach and ensures we work as an extension of your team so you’re still the one in control of your business. Ensuring transparent communication between lenders, brokers and borrowers is our specialty. A global service delivery model allows us to provide round-the-clock services so you can efficiently meet your goals.

Partner with us to experience the difference. Contact us today.

A preliminary title report is one of the first things to hit the desk when a potential sale is on the horizon. Think of it

We understand that as loan originators, ensuring compliance with HOEPA regulations is important for your business. And, if you regularly deal with high-cost loans, it

As loan originators, you’re not just navigating the market; you’re steering your ship through potential storms. A misstep can be costly and we’re sure that

Mortgage Processing: The Efficient, Effective, & Economical Way

In the meantime, follow us on LinkedIn for the latest updates and developments!

Warm regards,

Team Aritas Mortgage Solutions

In the meantime, why not explore our solutions to learn more about what we bring to the table.