What Is a Preliminary Title Report and Why Does It Matter?

A preliminary title report is one of the first things to hit the desk when a potential sale is on the horizon. Think of it

Contents

Picture this: a group of professionals gathered around a screen, graphs and numbers flashing like a Vegas slot machine. No, it’s not the latest Wall Street blockbuster; it’s just another day in the world of mortgage lending. Amidst the numbers, you’ll often hear a peculiar acronym: VOE. It stands for Verification of Employment and in the mortgage game, it’s what unifies the entire process and keeps it from falling apart. But why should you, as a broker or lender, care about this at all? Well, it’s not just another financial jargon. VOE is your golden ticket to ensuring that your borrowers are able to pay their mortgages.

Let’s take a closer look at the verification process.

VOE in the world of mortgage is the meticulous process through which a borrower’s employment status and income are confirmed. It’s the linchpin that ensures borrowers have a stable income to fulfill their monthly mortgage obligations.

Now, here’s where it gets interesting.

Against the backdrop of regulatory milestones like the Dodd-Frank Wall Street and Consumer Protection Act of 2010 and the watchful gaze of the Consumer Financial Protection Bureau (CFPB), the significance of accurate and comprehensive VOE has grown exponentially. These regulations are engineered to uphold both consumer protection and the integrity of the financial sector. They underscore the need for transparency, equitable lending practices and responsible lending.

Timing is everything in the world of mortgage and the efficient execution of VOE can make all the difference. A streamlined process ensures that you obtain the necessary employment and income verification documents promptly, helping you meet critical deadlines and reducing the risk of delays in your lending process.

Here are some VOE options that you can explore.

Each of these options has its pros and cons and the choice often depends on your specific needs, available resources and the level of control you want over the VOE process. Consider your priorities and objectives to determine which VOE solution works best for you.

Let’s say that you’re expected to crunch some numbers. You could choose to do the math on your own or speed up the process by adding the right formulas to an Excel sheet. Your math could be flawless but there’s always a risk of miscalculations. Likewise, you may opt for an in-house team for the VOE process but there’s always the risk of error and fraud.

Outsourcing mortgage process tasks to a third-party provider can be a strategic decision that offers numerous advantages, particularly when it comes to third party verification services. These services can play a key role in ensuring the accuracy and reliability of information provided by applicants.

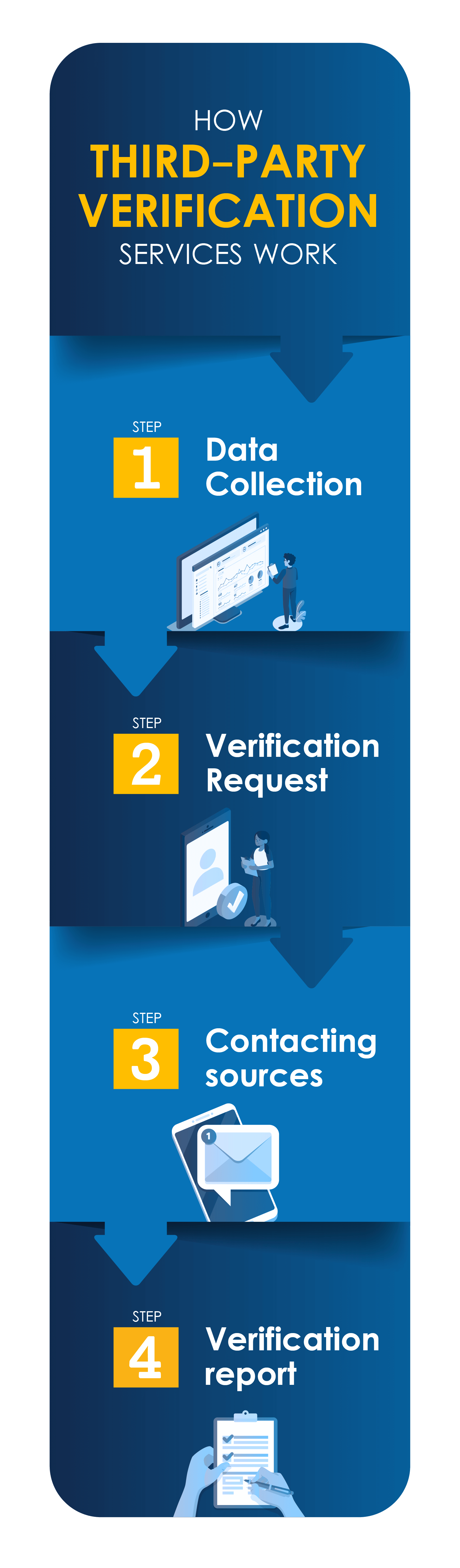

Third-party verification services: How they work

Third party verification services are integral to the mortgage application process. They involve independent verification of key information provided by borrowers, such as income, employment and assets to ensure accuracy. The process typically includes:

In a nutshell

Why outsourcing VOE to a third party is the best option

- Streamlines the process, ensuring quick verifications, saving time and resources

- Enhances data accuracy and security thanks to direct access to HR/payroll databases, reducing human errors and the risk of fraud

- Timely, data-rich updates that include pay information and employment details for thorough verification

You’re out for lunch with a potential client, telling them all about your services while your third party provider is taking care of your verification needs. That’s Aritas for you. We work as an extension of your team to optimize your operations.

Here’s how you can leverage this partnership

Benefit from our proven expertise

Backed by over 15 years of industry experience, our team is well-equipped to deliver efficient VOE services. Our longevity in the industry demonstrates our commitment to reliability and expertise in handling processes.

Stay on top of regulations

We help you keep up with relevant regulations, including the Fair Credit Reporting Act (FCRA). Our stringent adherence to these guidelines ensures that your VOE requests meet all legal requirements, reducing your risk and ensuring data accuracy

Reduce your turnaround time

Aritas understands the importance of timeliness in the mortgage industry. Our average turnaround time for VOE requests is among the best in the industry. Additionally, we offer expedited and rush services for urgent requests, so you never have to miss a critical deadline again

Be in sync with market demand

We recognize that the volume of VOE requests can fluctuate. Aritas offers the flexibility to accommodate variations in demand by adapting to the changing market demands

Comprehensive Services

Beyond Verification of Employment (VOE), Aritas offers a wide range of verification services, including Verification of Income (VOI) and Verification of Assets (VOA). This comprehensive suite of services streamlines your verification needs and simplifies your workflow.

When you choose Aritas, you’re choosing a partner dedicated to helping you navigate the challenges of mortgage verification with confidence and efficiency.

Ready to optimize your processes? We have great news. It’s the season of giving and we’re giving complimentary services for a month so you can experience the Aritas impact. Learn more about our offer here.

A preliminary title report is one of the first things to hit the desk when a potential sale is on the horizon. Think of it

We understand that as loan originators, ensuring compliance with HOEPA regulations is important for your business. And, if you regularly deal with high-cost loans, it

As loan originators, you’re not just navigating the market; you’re steering your ship through potential storms. A misstep can be costly and we’re sure that

Mortgage Processing: The Efficient, Effective, & Economical Way

In the meantime, follow us on LinkedIn for the latest updates and developments!

Warm regards,

Team Aritas Mortgage Solutions

In the meantime, why not explore our solutions to learn more about what we bring to the table.