What Is a Preliminary Title Report and Why Does It Matter?

A preliminary title report is one of the first things to hit the desk when a potential sale is on the horizon. Think of it

Contents

In the intricate journey of fulfilling, one’s dream to buy a home, mortgage loan processors like you play an important role. As the sun sets on meticulous applications and rising anticipation, borrowers step onto a path where efficiency and experience must meet half-way. You should ensure that in this phase, aspiration and achievement are bridged by unparalleled customer service to enhance the borrowers’ experience.

At this juncture, borrowers expect clarity and promptness, seeking seamless transitions from application to approval. An alliance between loan originators like you and processing experts like us becomes paramount especially at a time when price is no longer king. According to a McKinsey article, borrowers are more likely to recommend you if you’re able to offer a smooth mortgage processing experience.

We are committed to helping you improve borrower experience and navigate paperwork and verify details. As your processing partner, our role is to ensure you stay up to date. Our collaborative approach allows loan originators to flourish as guides while we streamline your back-office operations. In this article, we’ll explore the transformative realm of mortgage processing— where borrower dreams find their wings and lending aspirations find their zenith.

The mortgage processing journey comprises several orchestrated stages.

Having a dedicated processing partner by your side elevates this journey. We work closely with your team to expedite each step and fine-tune the process for optimal efficiency. Our expertise orchestrates seamless transitions, ensuring your borrowers experience a symphony of streamlined progress.

As your dedicated mortgage processing partner, we take pride in seamlessly integrating with your team, ensuring a journey that’s not only efficient but also enriching for borrowers. Here’s a quick walkthrough of how we support you through the various stages of mortgage processing, enhancing the borrower experience at every step.

As your mortgage processing partner, we understand the significance of a seamless application process for loan originators and borrowers. Our expertise lies in simplifying complex paperwork and optimizing data collection. Through intelligent form design and automated logic, we ensure borrowers only provide essential information, reducing confusion and enhancing their experience. For instance, if a borrower’s responses indicate self-employment, our system efficiently adapts to request-specific documentation, saving time and effort. This efficiency not only accelerates processing but also helps improve your customer relationships.

Effective communication is the cornerstone of successful lending. Partnering with us empowers you to offer borrowers transparent and accessible communication channels. We provide regular updates so borrowers can track their application’s progress, reducing uncertainties and boosting satisfaction rates. Clear communication minimizes unnecessary back-and-forth and can also improve your Net Promoter Score (NPS).

In the competitive mortgage landscape, tailored service can set you apart. Our role as your processing partner extends beyond administrative tasks. By doing so, we contribute to helping you foster trust and rapport. This translates into higher borrower satisfaction and a heightened likelihood of repeat business for loan originators. From addressing individual concerns to offering clear explanations, our team enhances the borrower journey, leaving a positive imprint on your brand.

Borrowers value visibility into their loan application’s progress. Our collaboration introduces efficient progress tracking to help stay informed and keep borrowers up to date with their application status—reducing anxiety and improving their experience. For loan originators, this means fewer status inquiries, enabling you to allocate more time to strategic lending activities.

Speed matters in the lending process. Our ability to effectively optimize workflows enables us to expedite each stage of processing. From document verification to underwriting analysis, our efficiency accelerates the journey. For loan originators, quicker turnaround times enhance your reputation and borrower referrals, ultimately boosting growth.

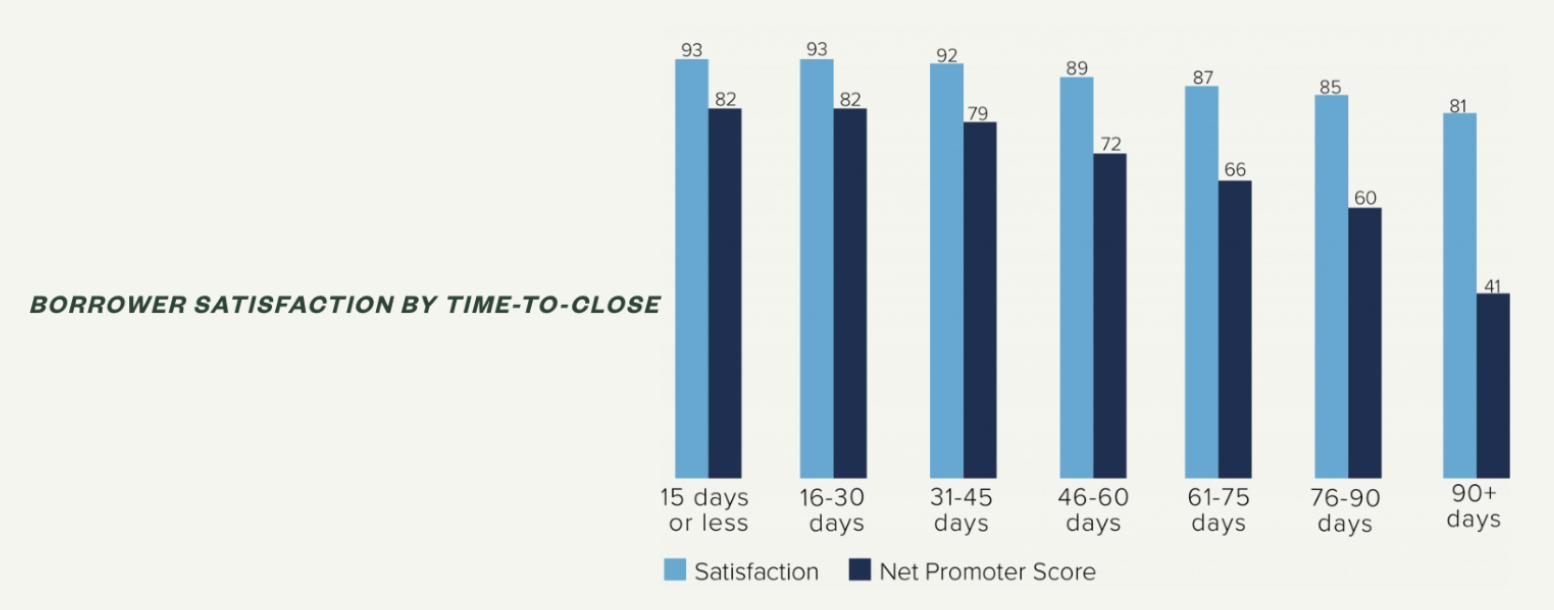

STRATMOR Group assessed 100K borrowers’ responses and found that borrower satisfaction and their willingness to refer you to others is linked to your time-to-close loans. Improving your turnarounds can significantly amplify borrower satisfaction.

Safeguarding borrower data is non-negotiable. Partnering with us ensures stringent data security measures are in place. As an ISO 27001 certified organization we prioritize data privacy and take every necessary step to keep all information confidential. Loan originators can set aside their worries about data breaches and compliance issues and focus on strengthening client relationships.

Meticulousness is our hallmark. Our quality control measures minimize errors, ensuring accurate applications. By maintaining a high standard of accuracy, we enhance borrower trust and reduce processing delays. For loan originators, this means smoother transactions and fewer post-closing issues, fostering a reputation for excellence.

The borrower journey continues after closing. Our role extends to post-closing support, addressing any lingering queries and concerns. This holistic approach ensures a lasting positive impression on borrowers.

In conclusion, our role as your mortgage processing partner isn’t merely administrative—it’s transformative. By streamlining processes, offering personalized support, ensuring data security, and more, we help you enhance borrower experience. We understand that each application represents more than a loan; it’s a step toward a borrower’s dream. Together, we orchestrate a symphony of service that resonates long after the final signature.

At Aritas Mortgage Solutions, we have spent over 15 years assisting mortgage lenders, brokers and title companies meet their goals. We understand that customer satisfaction can be a game changer for business.

Our team of skilled outsourcing staff has a proven track record of offering the support needed to drive growth for several small to large businesses. We can help you streamline operations, reduce operating costs and improve turnaround times without compromising quality. The best part? You can focus on strengthening client relationships while we do the heavy lifting for you.

Ready to transform mortgage processing? Contact us today.

A preliminary title report is one of the first things to hit the desk when a potential sale is on the horizon. Think of it

We understand that as loan originators, ensuring compliance with HOEPA regulations is important for your business. And, if you regularly deal with high-cost loans, it

As loan originators, you’re not just navigating the market; you’re steering your ship through potential storms. A misstep can be costly and we’re sure that

Mortgage Processing: The Efficient, Effective, & Economical Way

In the meantime, follow us on LinkedIn for the latest updates and developments!

Warm regards,

Team Aritas Mortgage Solutions

In the meantime, why not explore our solutions to learn more about what we bring to the table.